Investing in Rare Earths

Few investment sectors combine geopolitical intrigue, technological innovation and long-term growth potential quite like rare earth elements (REEs).

For Australians, the recent deal with the United States to supply rare earths to seed US$8.5 billion worth of new projects, has thrust the sector into the spotlight.i

What are rare earths?

Rare earth elements are a group of 17 metallic elements that, despite the name, are not particularly rare but are difficult and costly to refine. Their unique properties are essential in the powerful magnets that drive electronic devices such as headphones, speakers and computers, wind turbine generators, electric vehicles and medical technology such as magnetic resonance imaging (MRI).ii

They’re also used in lighting as well as screens and displays for TVs, smartphones and monitors and are vital in advanced defence systems.

In 2023, Australia was a top five global producer of 14 mineral commodities, including rare earths in addition to the more familiar bauxite, black coal, cobalt, gold, iron ore, lead, lithium, manganese, uranium and zinc.iii

Nonetheless, we’re a relatively small player in the market.

Almost half of the world’s known reserves of rare earths are in China.

China’s estimated 44 million metric tonnes of reserves dwarf our 5.7 million and the 1.9 million in the United States. Brazil has about 21 million metric tonnes.iv

Production and processing

Reserves are one thing (and exploration in Australia and around the world is continuing apace to discover new fields) but production and processing is what makes the difference for investors.

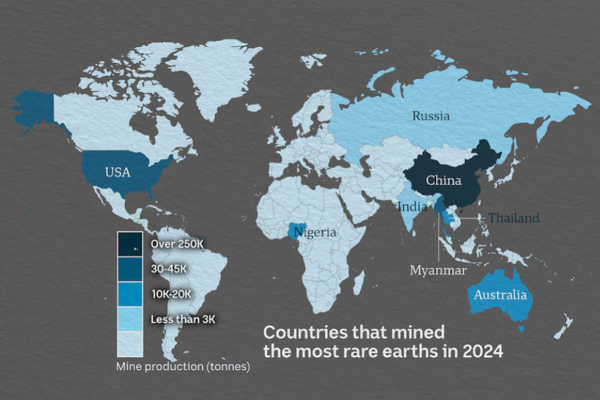

China is leading the field by a wide margin. It extracted and processed some 270,000 tonnes in 2024. The US was next with 45,000 tonnes, followed by Myanmar (31,000) and Australia, Nigeria and Thailand, each on 13,000 tonnes.v

Australia’s strategic position

The deal recently signed in Washington – the US-Australia Framework for Securing Supply of Critical Minerals and Rare Earths – commits both countries to investing at least US$1 billion each over the next six months to accelerate mining, processing and supply chain development for critical minerals.

Two of the projects were announced by Prime Minister Albanese after his recent meeting with US President Trump.

One project is the Alcoa-Sojitz Gallium Recovery project in Wagerup, Western Australia.

The Australian federal government will provide up to US$200 million in concessional equity finance for the project. The US government is also making an equity investment and Japan has provided about half of the project costs so far.

The project will provide up to 10 per cent of total global supply of gallium, essential for defence and semiconductor manufacturing.

The second project is the Arafura Nolans project in the Northern Territory.

The Australian federal government is making a USD$100 million equity investment in the project. Once operational, this project is expected to supply 5 per cent of global rare earth demand by 2029.vi

A third project has also recently been announced: Astron Corporation’s Donald Rare Earth and Mineral Sands project in western Victoria. A joint venture between Astron Corporation and the US uranium company Energy Fuels. It’s expected to become the fourth-largest rare earth mine in the world outside China.vii

The landmark Australia-US deal is a response to China’s dominance in the rare earths market and Beijing’s recent export restrictions on rare earths, which have left many nervous about vulnerabilities in the supply chains for defence and high-tech industries.

The agreement aims to diversify global supply chains so that other countries rely less on China by accelerating project approvals, supporting local processing and encouraging more private investment through government-backed financing.

Investment opportunities and risks

For some investors, rare earths may be seen as a long-term opportunity given a prediction by the International Energy Agency that demand could double by 2040.viii

There are several ways to invest including:

- Directly in ASX-listed companies such as Lynas Rare Earths (LYC), Arafura Rare Earths (ARU) or Iluka Resources (ILO)

- Through exchange traded funds (ETFs) or managed funds that offer exposure to rare earths miners and processors

- In private equity and venture capital. For high-net-worth investors, early stage mining and processing ventures may offer high risk, high reward potential

Of course, there are risks worth considering, with geopolitical volatility topping the bill. For example, global tensions or a change of mind by President Trump could easily disrupt the Australia-US deal.

Other risks include growing environmental concerns over the high water and energy demands for extracting and processing rare earth elements. There is also the risk of market manipulation and China’s ability to flood the market or further restrict exports, which could cause price volatility.

In any case, patience will be required. Mines can take as long as seven years to become operational.ix

The bottom line for investors is while rare earths are a sector still maturing, they are critical to a range of industries and expected to increase in value over the next decade. However, their share prices are sensitive to global headlines, politics and policy changes, so volatility is to be expected – particularly in the current environment.

As always, there is a lot to consider when weighing up investment opportunities and we are here to discuss any aspect of your investment strategy.

A look at global rare earths mine production in metric tonnes in 2024, as per data from US Geological Survey.

ABC News Graphics

i Historic critical minerals framework| Prime Minister of Australia

ii What Are Rare Earth Minerals Used For? | The Institute for Environmental Research and Education

iv, v Mapping rare earth supplies | ABC News

vi Historic critical minerals framework| Prime Minister of Australia

vii Donald rare earth mine given major project status | ABC News

viii Outlook for key minerals | IEA

ix Many details remain buried in Australia-US rare earths deal | Crikey